Warning for thousands on benefits who could have their payments STOPPED over summer holiday mistake

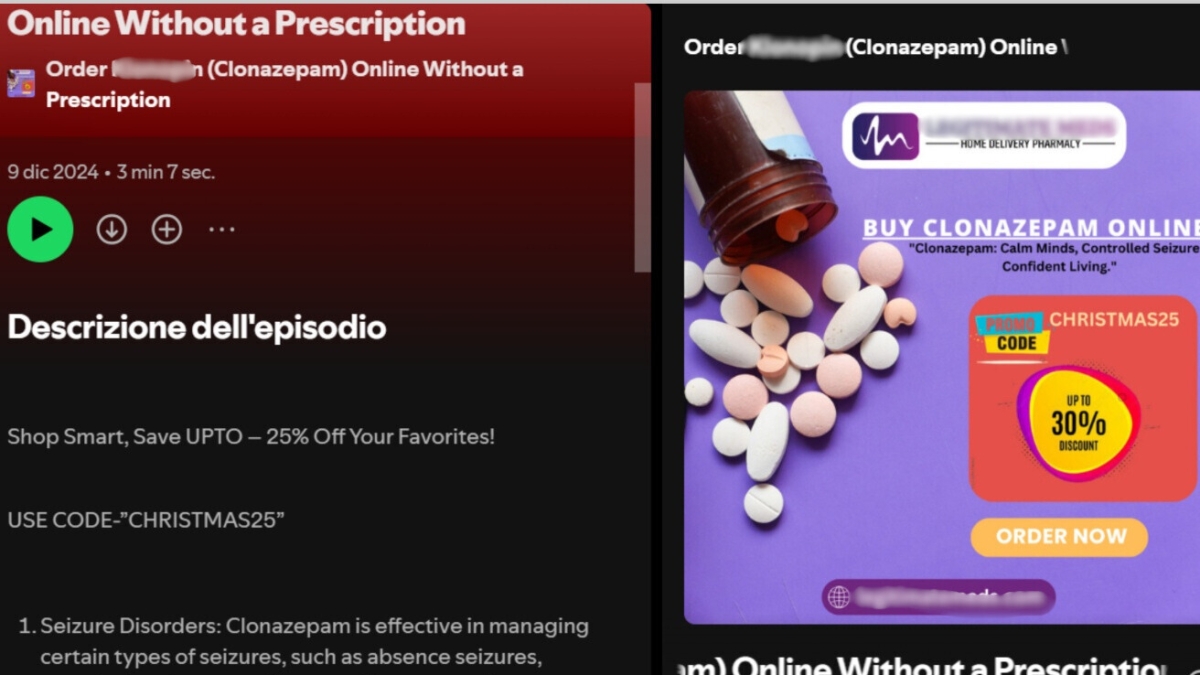

ANYONE on Jobseeker’s Allowance could see their benefits slashed and even fined up to £5,000 if they make one simple holiday mistake.

Those on the benefit heading abroad need to tell the DWP as it is classed as a change in circumstances.

Fail to do so, and it could see your claim stopped, reduced and you might be slapped with a £50 penalty.

If you’re found to have deliberately not reported going away, this is classed as benefit fraud, which is illegal.

In this case, you will be told to pay back any overpaid benefits you’ve received.

You may also be taken to court or asked to pay a penalty between £350 and £5,000.

Sarah Coles, senior personal finance expert at Hargreaves Lansdown, said: “There’s so much to do before you go away, but if you’re claiming benefits and travelling overseas, make sure you tell the DWP.

“It may not seem important, but if you don’t let them know you could have your claim stopped or cut – and you could even be fined.”

The exact government rules state that you cannot claim income-based JSA while abroad.

You may be eligible to claim New Style JSA though, if you’re in the European Economic Area (EEA) or Switzerland for up to three months.

However, you also need to:

- be entitled to it on the day you go abroad

- register as a jobseeker at least four weeks before you leave

- be looking for work in the UK up to the day you leave

- be going abroad to look for work

- register at the equivalent of a Jobcentre in the country you’re going to

- follow the other country’s rules on registering and looking for work

- be covered by the Brexit Withdrawal Agreement

The same rules that apply to going abroad if you’re on Jobseeker’s Allowance also apply to a host of other benefits.

If you are on Universal Credit, you can stay abroad for one month and carry on receiving payments.

But, you have to tell your work coach you’re going away and carry on meeting the conditions of your claim.

There are exceptions, such as if you’re abroad for medical treatment (you can stay up to six months) or if a close relative passes away.

Meanwhile, if you receive Personal Independent Payment (PIP), you can stay abroad for up to 13 weeks, or 26 weeks for medical treatment.

How to report a change in circumstances

How you can report a change in circumstances varies depending on your benefit.

If you’re on JSA, you have to report any changes by calling the JSA helpline on 0800 169 0310.

The helpline is open Monday to Friday, 8am to 5pm.

You can also write to the Jobcentre Plus office that pays your JSA, the address for which will be on any letters you get about your JSA.

If you’re on Universal Credit, you can send a message on your journal, or speak to your work coach.

You can contact the Universal Credit helpline on 0800 328 5644, or you can textphone to 0800 328 1344 too.

The line is open between 8am and 6pm Monday to Friday.

If you want to speak to someone in Welsh, the number to call is 0800 012 1888.

For other benefits, check the government’s website.

Are you missing out on benefits?

YOU can use a benefits calculator to help check that you are not missing out on money you are entitled to

Charity Turn2Us’ benefits calculator works out what you could get.

Entitledto’s free calculator determines whether you qualify for various benefits, tax credit and Universal Credit.

MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data.

You can use Policy in Practice’s calculator to determine which benefits you could receive and how much cash you’ll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.